27th August 2020

Split Velocity offers Hope for Recovery

We tried to forewarn and inform about the weaknesses of current strategies.

On Tuesday 25th June 2019 [a year ago] under the heading “Ending poverty by default: A challenge for this age” [scroll further down to read this] we alerted the central bank to the inadequacy of applying conventional monetary policy strategies initiated by the monetary policy committee at the time. An economy facing stagflation that is at the limits of its borrowing capacity (Zambia is at 70%) is generally out of options. Its only recourse is to find a benefactor to borrow from. It was hoped and it is still hoped one would be found for Zambia and being patriotic, like everyone else, we still hope this works out.

However, textbook approaches to economic management do not work for developing countries due to the fact that they are generally created for Western models where economies are wealthier and have access to hard currencies. For developed countries to doggedly follow the same style of management as developed countries when developing countries do not have hard currencies and are resource constrained rather than resource endowed does not make sense, in fact it defies logic. It is also important for African nations to be wary of the fact that even state of the art theories and understanding of economics in the world today applied by developed nations has not advanced to where they have identified the unconscionable and pointless waste or loss of income caused by a poorly designed circular flow of income.

Developed countries, at least by contemporary standards, are wealthy. This is evident in their much higher GDP and per capita incomes. Therefore, their primary concern for decades has been how to contain this wealth and not lose it. This has subconsciously influenced the knowledge paradigm that is economic theory today. Since the objective is to contain wealth, the focus is not wealth creation. Even mediocre annual growth rates are sufficient to maintain the status quo of existing wealth. Mediocre growth rates of 4% or 5% are sensible in the context of the huge sums in GDP they are applied to. It explains why they have never identified losses due to inefficiency of the CFI. They have never had a need to identify methods for rapid or accelerated growth. Developing countries are poor. In comparison they have much lower GDP and per capita incomes. Nevertheless, they implement the very same knowledge paradigm for economic theory and confidently pursue the same 4%-5% growth rates applied to insignificant GDP and therefore unsatisfactory economic gains that perpetuate their own underdevelopment whilst leaving them wondering why poverty does not seem to end. Since they don’t have any wealth to contain, what they are in effect containing and sustaining, in state of the art practice, is their own poverty perpetuated by a knowledge paradigm that believes slow or mediocre annual growth is accurate, worth aspiring to and they mistake this position for conventional wisdom to live by.

Resource constrained countries struggling with underdevelopment, poverty and debt simply cannot sit back and allow these lapses in theory and the valuable resources that could be put to good use laid waste, further ravage their economies. If this is the path that remains and continues then more inflation, underdevelopment, an unmanageable economy, difficulty and suffering may be the inevitable result. Nevertheless, there is always hope and ways to navigate the economy toward prosperity can be strategized.

Applying a Split Velocity system for managing a national economy is ideal for developing countries like Zambia because it assumes the nation has no resources, must rely on its own ingenuity and act within its own capacities. SV-Tech assumes any country applying the methodology is resource constrained and therefore must find alternative ways of generating its own internal financial resources to enhance productivity whilst maintaining price and financial system stability.

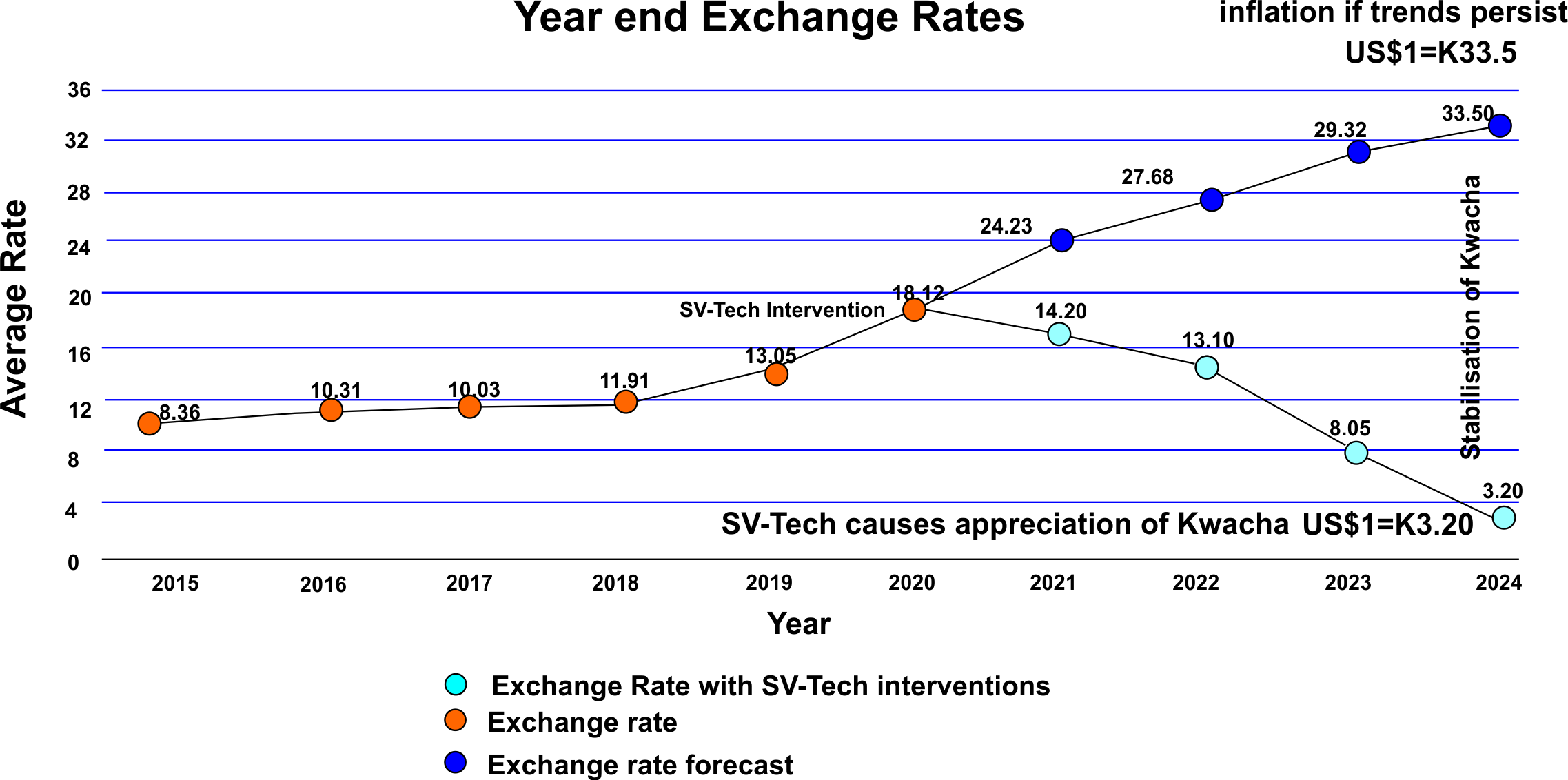

A Split Velocity model unlocks the equivalent of GDP at constant price. This revised strategy would unlock the equivalent of up to US$26 billion for the Zambian economy (that is, the equivalent of GDP per annum) as well as new monetary policy tools with which to wrestle the Zambian Kwacha from US$1 – K18 back down to US$1 – K1 if this kind of parity was desired by the central bank. It would do this with results gained in record time.

Unlike other strategies, though unconventional, a Split Velocity model is safe, guarantees its outcomes and is grounded in sound financial practice and productivity. Most importantly it is self-reliant, countries do not have to look for a benefactor to help bail them out of crisis, they can use their own tenacity and initiative to raise the resources they need sustainably to transform the lives of citizens.

It is important to note that even with current development strategies the forecast per capita income for Zambia in 2030 is US$1,639.00 – US$2,185 (MoF). This is an alarmingly low increase of US$300 – US$878 after 10 years of economic activity – (a gain of US$87 per year -Zambia may not meet the 7NDP goals and may be worse off in 2030 than it is today, except with a much bigger population notwithstanding unanticipated shocks for which there is currently little or no capacity for mitigation). There is a need to address what realistic difference a per capita income gain of only US$87 a year for 10 years will make in people’s lives, especially if there are unexpected shocks as a risk factor along the way, before this time is lost and can never be regained. On the other hand Split Velocity offers per capita income advances over the same period of up to US$26,714.15 per capita with guarantees, no unnecessary losses to inflation that make results redundant and provisos inherent within the system to deflect shocks to the economy that may interfere with objectives.

Let it be noted that this change in per capita income only deploys 42%-48% of the resources . made available by the Split Velocity System. In other words it does not stretch either the resources or imagination of this technology and its capacity to transform the Zambian economy. The only barrier is the mindset of technocrats. In fact the straight forward capacity of developing economies to achieve these results is demonstrative of how far behind the learning curve developing countries and managers have fallen by trying to implement approaches more suitable for wealthier economies than their own.

This means that a Split Velocity system continues to offer hope as a means that can be deployed for transforming the economy especially in the wake of unexpected shocks. It leaves no ambiguity as to where the resources are with which to achieve these gains. This is achieved without even maximizing or exhausting the resources generated by the Split Velocity system. It is not peddling fairy tales or fantasies, and is not based on guesstimations but provides hard facts and mechanisms for achieving results that will not disappoint implementors in both developed and developing countries.

See the tables below to see how much developing countries in Africa are losing daily and annually to an inefficient and faulty economic operating system in the circular flow of income (CFI). The recovery of these resources could be used to transform lives.

23rd June 2020

Enhancements SV-Tech can bring to the SDR system

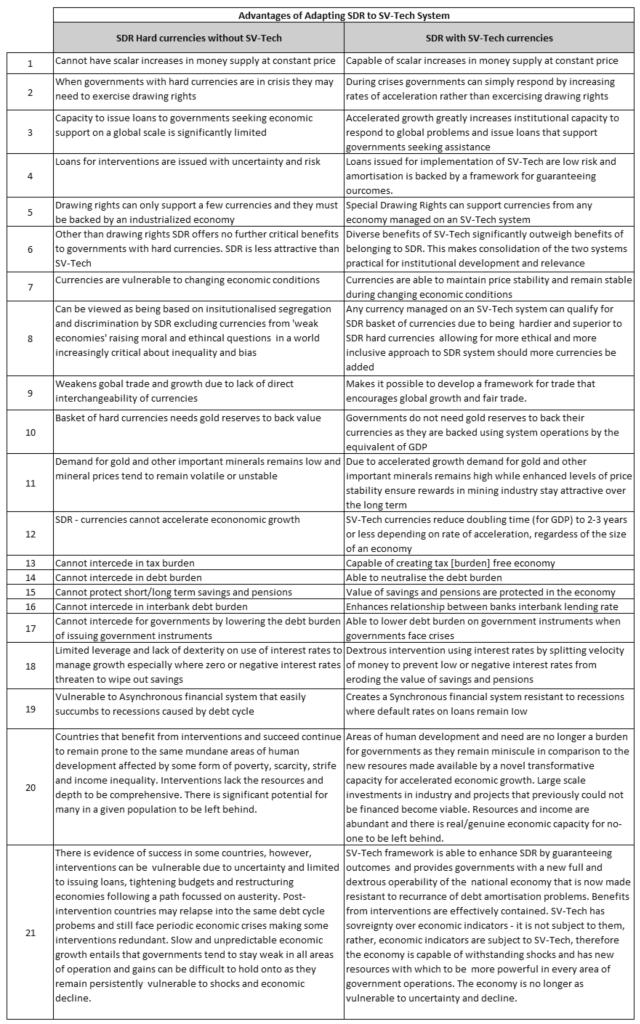

A Split Velocity system manages price stability and is capable of wiping out chronic inflation for governments that struggle with either a depreciating or appreciating currency. The table below highlights the benefits SV-Tech can bring to the Special Drawing Rights (SDR) system.

8th June 2020

Discerning if Innovation and Technology adds Value to Precious Metals

The options for maintaining price stability being observed here are innovation and technology (e.g. SV-Tech) as opposed to precious metal (e.g. gold). Which is the most useful?

If you have performed the Instruction Set for a Legally Admissible Empirical Test for Split Velocity then you have successfully evaluated Split Velocity by way of empirical test.

Let us now compare SV-Tech (Split Velocity) to Purchasing Gold as a means of maintaining price stability.

The Instruction Set for the Empirical Test revealed a money supply deficit equivalent to GDP [-(B+C)] caused by subtraction. It was further noted that this represented a correction of money supply and not an increase in money supply. Therefore, this enables a correction equivalent in domestic currency value to GDP at constant price.

This means that the empirical test shows that the Split Velocity system is able to support, hold or maintain the Zambian exchange rate, for example US$1 to K5 or US$1 to K1 by the equivalent of GDP per annum or US$25.8 billion in 2018. In essence SV-Tech allows a domestic currency to behave like and gain many of the attributes of a hard currency, a system that has never been possible prior to SV-Tech or achieved before in central banking history. In fact, even in terms of the scalar increase of money supply, an IMF reserve currency cannot be used to increase money supply in this way at constant price (without inflation). Furthermore, the supply of gold cannot be increased on a scalar level, at constant price (because the price of gold would fall as a result of over supply). In this regard a Split Velocity system outperforms both gold and hard currency, a feat currently regarded as impossible or improbable. Consequently, where credibility and currency stability are concerned it even outperforms the Special Drawing Rights (SDR) reserve currency system presently in use by the International Monetary Fund (IMF), which is much weaker than a Split Velocity system. SV-Tech is at the very cutting edge of the Fintech space. The SDR system was introduced in 1969, a period when emoney, internet banking, debit and credit cards, cryptocurrencies and tech based financial innovations did not exist, therefore it should come as no surprise that innovations in the Fintech space will inevitably evolve that can achieve the same objectives as the SDR and that encourage a more inclusive approach to how currencies are managed and appraised. At the technical level, the fact that it can be demonstrated that where price stability, economic strength and reliability are concerned, a currency managed using a Split Velocity model outperforms a currency in the SDR system should be good news in that it complies with the merits for which the SDR system was created and exists in the first place. This development will allow for less discrimination when it comes to how domestic currencies are viewed.

For any central bank in the world, to be able to back its domestic currency with the same strength as a Split Velocity system it would have to be able to purchase and hold gold per annum equivalent to its annual national GDP. (To add some perspective to this, not even the United States Federal Reserve Bank has the capacity to back the US dollar at this level, to do this, it would have to upgrade to a Split Velocity System).

This means that for the central bank to be able to back the Zambian kwacha and exchange rate with the same capacity as Split Velocity, it would have to purchase and hold US$25.8 billion worth of gold and maintain the equivalent in GDP in gold as a reserve. ZCCM-IH and mines in general in Zambia are unable to produce this much gold, and even if they could produce and supply it, government could simply not afford to buy it all.

In addition to this, depending on market conditions, the price of gold rises and falls forcing a central bank to ride unpredictable trends, whereas a Split Velocity system maintains price stability even while economic conditions rise and fall. A Split Velocity model, when used to manage a national economy, is not subject to economic indicators, rather, economic indicators are subservient to a Split Velocity model. For instance, it does not wait to see what economic growth will be experienced, it sets and guarantees the growth rate.

Frankly, when it comes to price and financial system stability, gold and other precious metals need Split Velocity to maintain and sustain their value by sustaining higher levels of economic growth and maintaining a stable national economy. When it comes to financial system stability, this is one condition in which innovation is the more advantageous option.

Its important to understand that natural resources and mineral wealth are not a panacea for economic growth and national prosperity, the thought and strategy must delve much deeper and move far beyond this obstacle by appreciating that any price stability or grandiose economic benefit that any precious mineral like gold or other natural resource could deliver for the country would have already been delivered by copper, by now. There is a need to push beyond these limitations with the understanding that some countries with no natural resources have industrialized and formulate a strategy that scrutinizes the operational structure of the systems in place by which development objectives are achieved.

To discover minerals such as gold and other precious minerals is always beneficial to a country and its people and should receive as much attention and support as possible. We live in a technical age in which innovations like SV-Tech represent safe hands when it comes to the direction to take towards creating a better life and a better world for the youth, without leaving anyone behind.

Mining and precious minerals are cardinal to development, have their uses and should be invested in, nevertheless, for a central bank, anywhere in the world, purchasing gold as a way of trying to maintain financial system stability, is in no uncertain terms, simply no comparison whatsoever to deploying a Split Velocity system.

The raw power, dynamic capacity for growth and agility of finance in a Split Velocity system means that any country managed on this system can enjoy the benefits of a domestic currency that performs at the same level of stability and reliability as that of a hard currency backed by a fully industrialized economy and with less of the kind of volatility seen in the currencies of developing economies.

The mechanisms it innovates to be able to do this are fairly easy to demonstrate.

When reference is made to a need to advance the knowledge paradigm in economics, finance, accounting and business it should be emphasized that retraining is required to understand the counter-intuitive processes of a Split Velocity system. For instance, if a student graduated today they would still be trained to believe the CFI is efficient and lossless. However, the empirical test for Split Velocity clearly shows that the CFI is dysfunctional and inefficient in a manner anyone, even laypersons, can see and understand, and it is creating monetary and fiscal instability, makes global poverty inherently unmanageable as well as costing governments billions of dollars.

Similarly, the generic tutelage in finance is that an increase in money supply will cause inflation, or the over supply of any product such as gold will cause a drop in price. If a student graduated from university today this is what they would believe. However, we can provide an empirical test to teach and demonstrate, even to laypersons, that a Split Velocity model allows increases in money supply to take place at constant price. Instead of inflation the economy experiences the inverse, that is, economic growth. No currency in the world today, not even that of industrialized nations or even a precious metal can maintain price stability in this way. This is very important for developing countries because it means in a Split Velocity system the domestic currency can technically perform more efficiently than any present day reserve currency belonging to an industrialized nation.

These are just the facts. Developing countries should not believe they are trapped by poverty and circumstance. Prosperity belongs to all nations and all people, not just a select few. The knowledge paradigm is key.

Most importantly, by acting diligently and expediently, this means that it is possible today to guarantee the youth a future without uncertainty, with opportunity and economic independence, not as a lofty or empty promise, but with a working strategy that will deliver within this generation.